oklahoma franchise tax payment

Oklahoma Should Prioritize Pro-Growth Relief Not Gimmicky Rebate Checks. The report and tax will be.

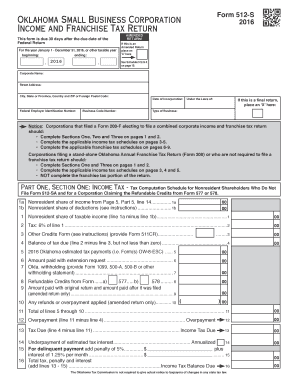

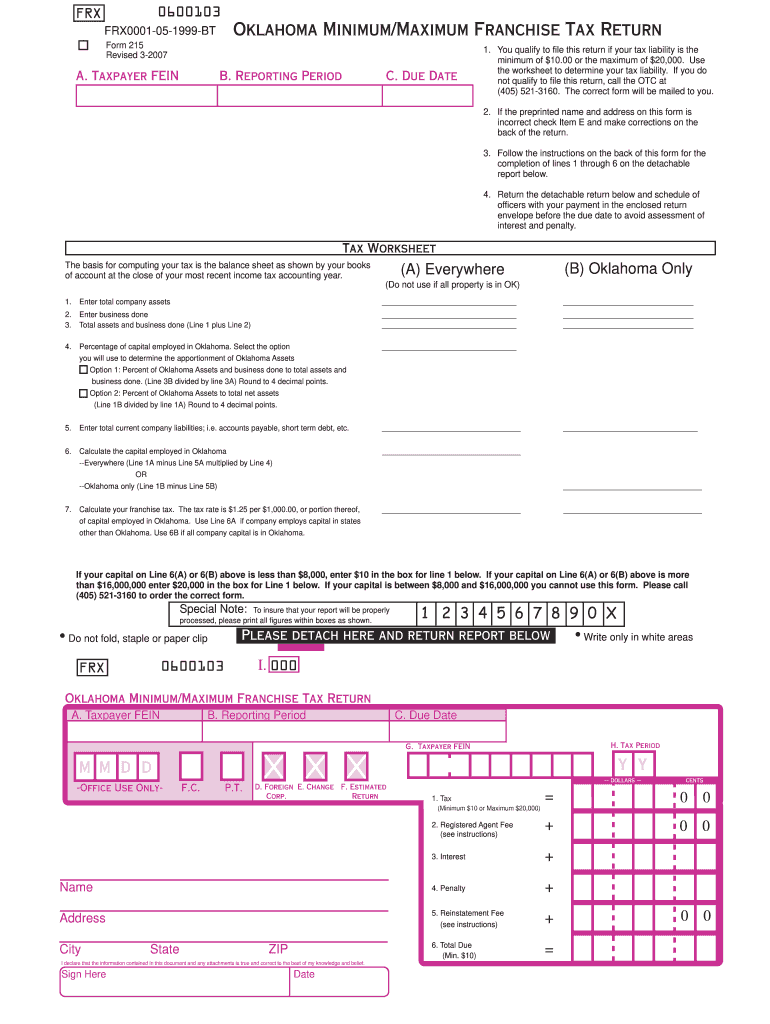

Fill Free Fillable Forms State Of Oklahoma

The franchise tax is calculated at 25 cents per every 1000 of the corporations capital employed in or allocated into the businesss outpost within the state.

. Up to 25 cash back Also in 2018 the amount of your corporations capital allocated invested or employed in Oklahoma was 250000. Other tax cut proposals being considered. And you are not enclosing a payment then use this address.

Foreign not-for-profit corporations however are still required to pay the 10000 registered agent fee. If you live in Oklahoma. Corporations are taxed 125 for each 1000 of capital invested or otherwise used.

Not-for-profit corporations are not subject to franchise tax. Other things being equal the. Oklahoma Board of Medical Licensure and Supervision Payment Center To promote the Health Safety and Well-being of.

How do I login to the Oklahoma Taxpayer Access Point OkTAP. The rate is 125 for each 1000 of capital you invest or use in Oklahoma. All businesses and associations in Oklahoma are required to pay a Franchise tax.

Enter your OkTAP username and password and click. To login click the Login button on the top right of the OkTAP homepage. You will be automatically redirected to the home page or you may click below to return immediately.

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax. Accepted Payment Methods include. The states franchise tax is currently 125 levied for every 1000 of capital a business has allocated or employed in the state.

Your session has expired. As out-of-control inflation strains families budgets lawmakers across the country are casting. For every 1000 of investment 125 of tax is levied with a maximum limit of 20000 in a.

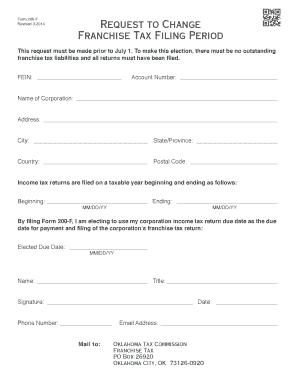

Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form 200-F has been filed. For corporations that owe. And pay franchise tax.

Pay Your Tax Bills Online Now. And you are enclosing a payment then use this address. And you are filing a Form.

Oklahoma levies a franchise tax on all corporations or associations doing business in the state. Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement Feedback OKgov Last Modified 10222007. Oklahoma requires all corporations that do business in the state to pay a franchise tax.

Wisconsin Tax Rates Rankings Wisconsin State Taxes Tax Foundation

Form 200 F Fill And Sign Printable Template Online

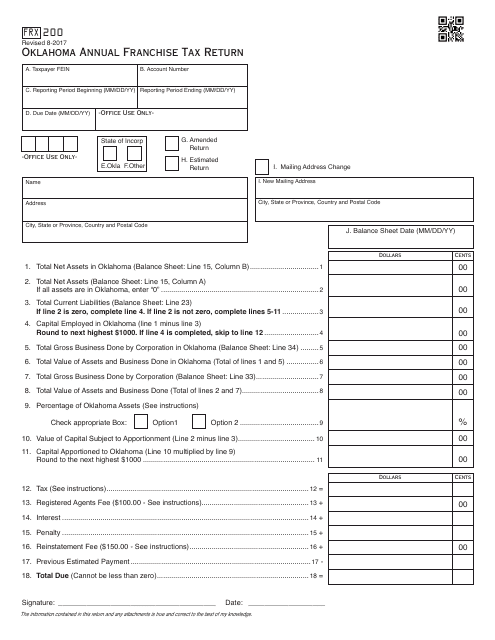

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Oklahoma Business Registration Oklahoma Llc Incfast

Tax Resolution Examples In Oklahoma 20 20 Tax Resolution

Oklahoma Tax Commission The June 15 Tax Payment Deadline Is One Month Away Oklahomans Have Until June 15 2021 To Pay Their 2020 Individual Business Income Taxes And Their First

Fill Free Fillable Forms State Of Oklahoma

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

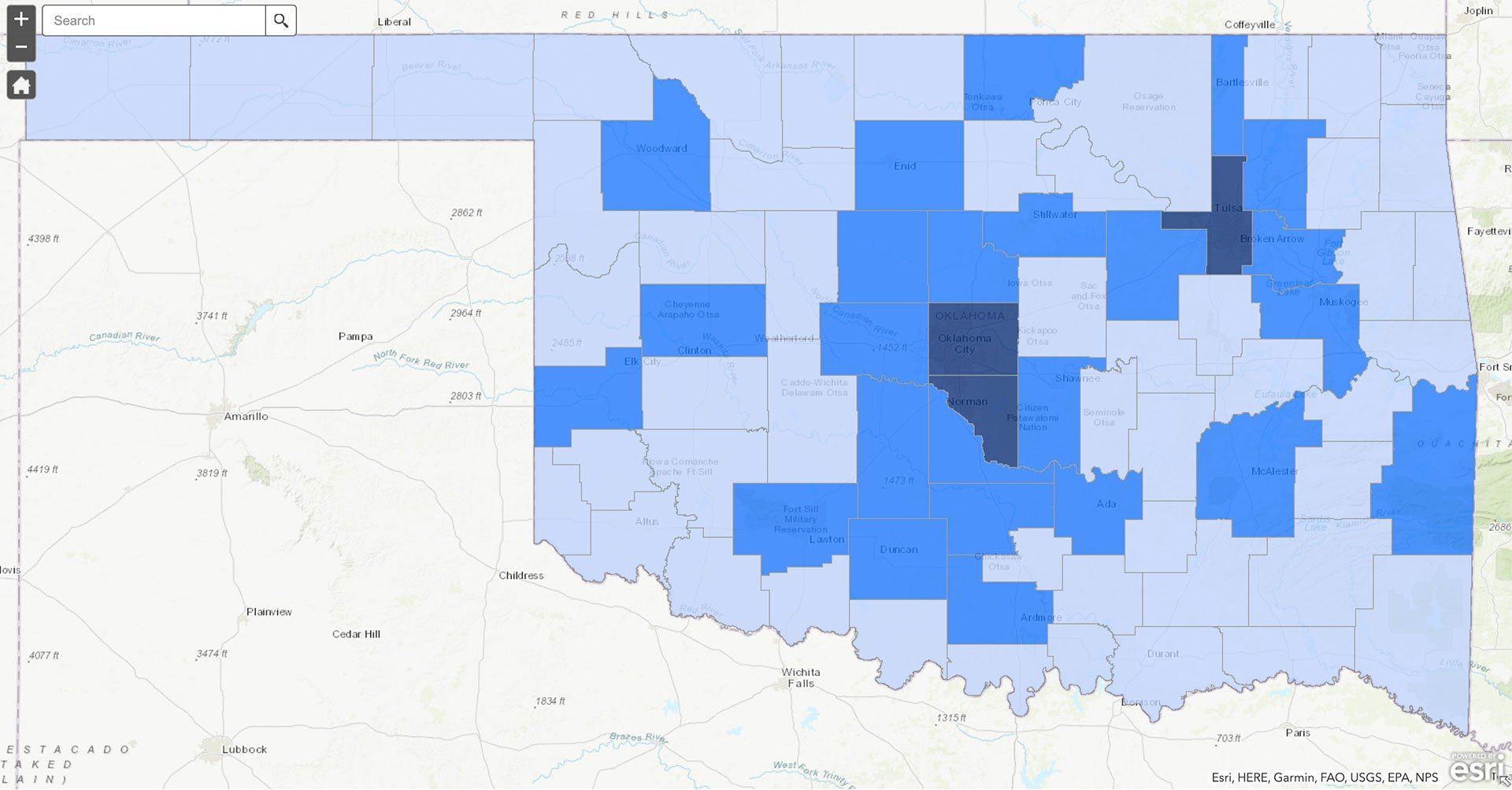

Oklahoma Business Relief Program Reporting Oklahoma Department Of Commerce

Free Oklahoma Tax Power Of Attorney Form Bt 129 Pdf Eforms

Usa Oklahoma Oge Energy Utility Bill Template In Word And Bill Template Utility Bill Templates

Incorporate In Oklahoma Starts At 49 Zenbusiness Inc

Oklahoma 215 Fill Out Sign Online Dochub

Viewpoint Tax Cuts Would Harm Oklahoma S Economy

Free Oklahoma Tax Power Of Attorney Form Bt 129 Pdf Eforms

Start A Nonprofit In Oklahoma Fast Online Filings